May 29, 2016 – Healthy Lawns: Healthy Non-Fossil-Fuel Investing

The logic of natural lawn care

Even if you host a program that often concerns itself with growing food, the subject of lawns is going to rear its ugly head eventually. Hey, lots of us have lawns. I even have enough of a lawn to have to mow every now and then, though it exists mainly as a reason for me to walk barefoot through my small Logan Square yard.

When it comes to how I treat my lawn, however, I think the appropriate phrase is “benign neglect”: no fertilizers, no pesticides, almost no watering, hand-weeding, perhaps a little compost applied every couple of years. The result? It looks good and it makes me happy and that’s all that counts, right?

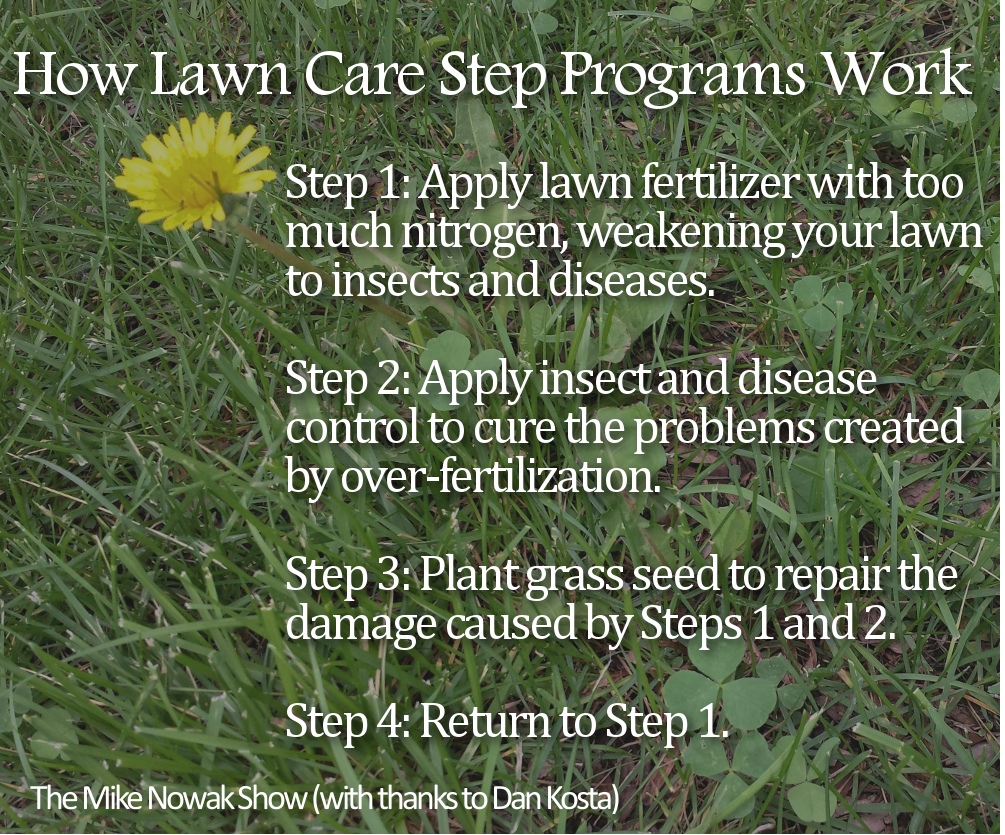

Which leads us to our first guest today, Steve Neumann of Logic Lawn Care in Evanston, Illinois. Their goal is to be sustainable in everything they do. They define sustainability as

An approach that meets the needs of our customers today, while focusing on improving, not harming, the environment and natural resources for future generations.

It’s with that philosophy in mind that Logic approaches fertilization, weed control, pest and disease control, landscape maintenance, design and installation and even edible gardens.

Because the average American homeowner is obsessed by lawn care, this conversation could last a few days. We have about half an hour, so get your questions in early.

Learn about urban gardening and food forests this summer!

What can you say about an organization that has donated more than 20,000 pounds of organic food to pantries and food kitchens in Chicago? I’m talking about the KAM Isaiah Israel Food Justice and Sustainability Committee, which first broke ground in April, 2009. Since then, they have grown food, taught others to do the same and even collected produce that would otherwise have gone to waste as part of their White Rock Gleaning program.

In addition, for seven years they have presented their Martin Luther King, Jr. Food Justice and Sustainability Weekends in the dead of winter (usually around my birthday). In other words, they’ve been incredibly effective during a relatively short period.

The point person–but by no means the only fiercely dedicated individual–for these efforts has been architect Robert Nevel. He has appeared on my show many times and is back to promote the KAM Isaiah Israel Farm & Food Forest School 2016.

It’s an intergenerational experience designed to teach folks Interested in learning about growing food, designing and installing food forests and more. There are eight free workshops in July and August at KAM Isaiah Israel’s award winning micro-farm and food forest in Hyde Park. The class is filling up and Nevel will tell you how to get involved.

Remembering Margaret Eyre

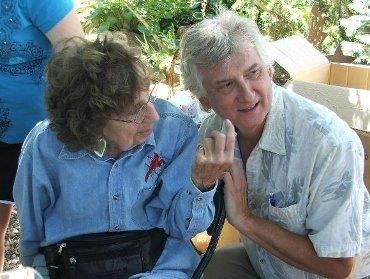

There have always been a number of reasons to visit Rich’s Foxwillow Pines in Woodstock, Illinois: the exquisite selection of rare and and dwarf conifers and other trees, the chance to hear Rich Eyre wax poetic on his travels to collect those specimens, and the disarming wit of his partner in crime Susan Eyre.

But perhaps the best treat was the opportunity to talk to the  irrepressible Margaret Eyre, who was the force behind the “Hosta Happenings” on site and, indeed, the nursery itself. She died in January of 2016 at the age of 97 and June 4 is the date of the first Hosta Sale without her comforting presence.

irrepressible Margaret Eyre, who was the force behind the “Hosta Happenings” on site and, indeed, the nursery itself. She died in January of 2016 at the age of 97 and June 4 is the date of the first Hosta Sale without her comforting presence.

As always, there will be more than 500 varieties of Hostas for sale, (at the very reasonable prices of $5 and up) to benefit Heifer International, and Bolivian handicrafts for sale to benefit Mano a Mano International Partners.

In addition, Heifer International will present a tribute to Margaret Eyre at 10am. Rich and Susan Eyre are back on my show this morning to talk about this terrific event.

Investing in funds that allow you to sleep at night

I’ve discovered that I have something in common with Donald Trump. It’s pretty simple, actually. If you look at our tax returns, you’ll see that we make much less money than most folks think we do. However, doing that is a problem, because I don’t care who sees my tax returns. Not so much for The Donald.

Which leads us–indirectly, I confess–to the idea of financial investments. There are a lot of folks in the 21st Century who would like to sock their money into entities that will return a profit–but not at the expense of the planet. That is to say, they would prefer not to put money into the pockets of the oil, gas and coal industries, among others. Good luck with that, honey, has always been my advice.

However, I recently received a news release about a business called ETHO Capital, which stated that

ETHO, the world’s first broadly diversified, socially responsible and fossil-free exchange-traded fund (ETF), is available for trading on the New York Stock Exchange…

The ETHO ETF is based on the Etho Climate Leadership Index (ECLI), an index of 400 U.S.-listed stocks that is completely divested of fossil fuel companies, rigorously screened for sustainability criteria, and constructed of only the most climate-efficient companies in each sector.

“Uh…okay,” I said, skeptically. Let’s have you on the show to talk about how that works. To that end, co-founder, president and chief sustainability officer Ian Monroe joins me on the program this morning. He is also Founder of Oroeco and a lecturer on climate change and life cycle assessment science at Stanford University.

In the meantime, I remembered that I had run into a fellow named Tom  Nowak (no relation) at an environmental rally at Daley Plaza about a year and a half ago. Since I never, ever delete emails (not something I recommend as a standard business practice.–except to Hillary Clinton), I was able to track him down.

Nowak (no relation) at an environmental rally at Daley Plaza about a year and a half ago. Since I never, ever delete emails (not something I recommend as a standard business practice.–except to Hillary Clinton), I was able to track him down.

Tom is founder and Principal of an outfit called Quantum Financial Planning LLC, a Fee-Only financial planning and Registered Investment Advisory firm located near Grayslake, Illinois. I’ll be honest with you–I don’t even know what “fee-only” even means.

However, he sent me a website about Low Fee Socially Responsible Investing. That site can send your down a number of roads, including “fossil free,” “political accountability,” “racial harmony,” “peak water portfolio” and more.

I have always thought that no matter who is doing the talking, the people behind leading you through investments are basically sharks who have smelled your blood in the water. To that end, you should check out this article from Grist called Looking for a Fossil-Free Investment Fund? Check the Fine Print. You might also want to look at this story from The Guardian.

I also suspect that most folks are like me in that a) they don’t trust investment companies and b) they don’t have any money to invest anyway. Am I wrong? Perhaps I’ll get some answers this morning.